Expand Your Portfolio Without Personal Income

Industry-Leading private money & dscr loans

No paystubs, tax returns, employment verification, PFS, or personal debt ratio calculations – just faster closings and greater opportunities.

Allow us to finance your reserves to waive off bank statements and make your loan payments for you. See if you qualify today!

Take 3 minutes to request a term sheet or proof of funds letter by clicking on one of the 5 loan types below. You can also read my reviews, book a call or send me a call, text or email

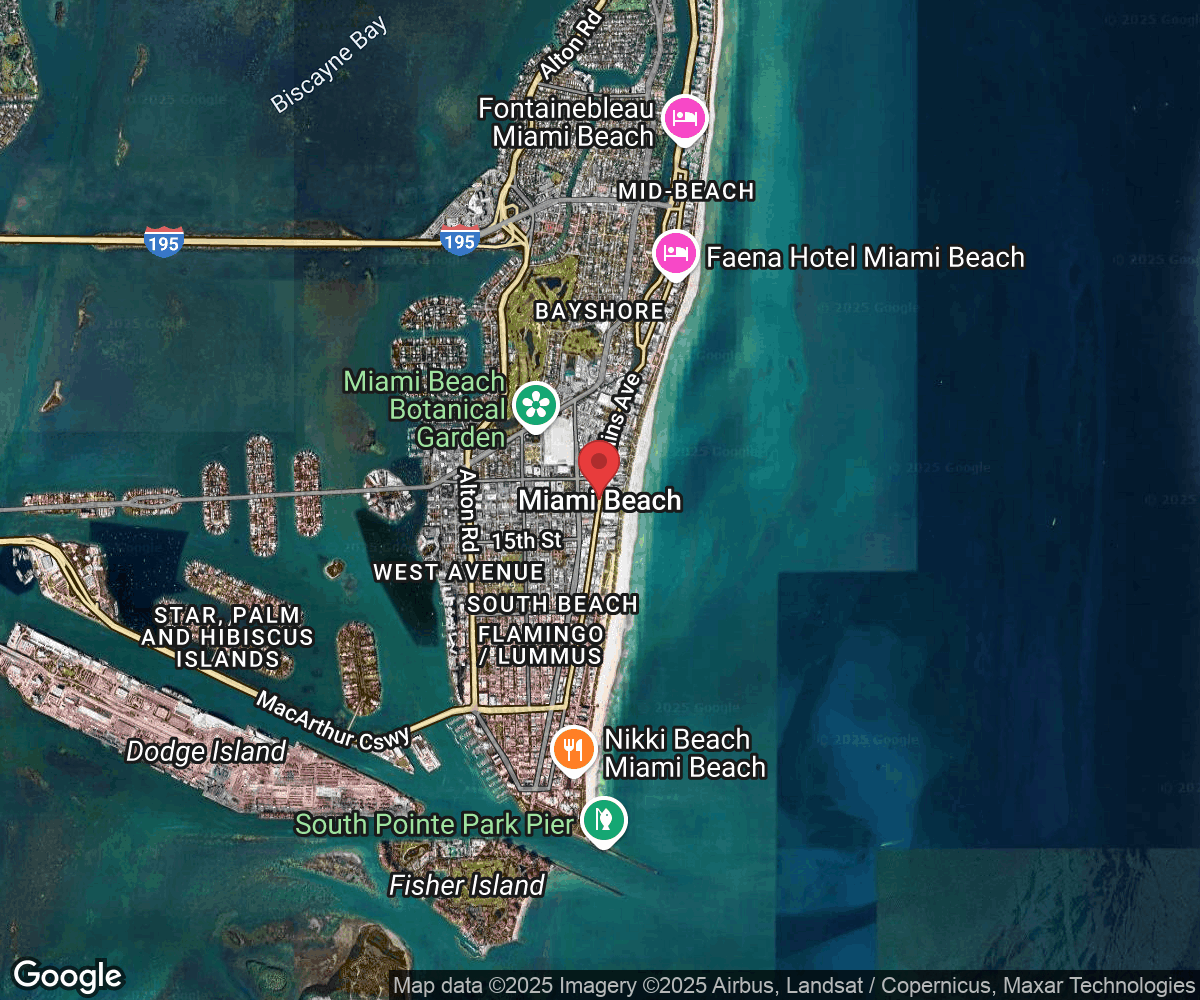

With 10+ years in real estate and 6+ years in private money lending, We've built The Consulting Hub to solve the capital constraints that limit investor growth.

We specialize in innovative funding solutions that help real estate investors scale without cash flow barriers.

We work with referral partners across all funding services to create win-win relationships. Whether you're an agent, broker, contractor, or investor with clients needing creative financing, let's explore partnership opportunities.

Email us to discuss how we can add value to your network.

Ready to scale without cash constraints?

Let's schedule a call to discuss up to 100% financing solutions:

• EMD Funding - Up to $100k for earnest money deposits

• Double Close Funding - Same-day closings up to $100M

• Seller Carry-Back Method - Eliminate gap funding needs - Up to $1M with 1-2 day closings

• First Lien Coordination - Connect with vetted lenders

• Full Transaction Support - From contract to closing

Contact us today to turn your deal pipeline into closed transactions.

Frequently Asked Questions

What documents are needed to get a loan?

You’ll need our simple PDF loan application and disclosures, stamped articles of formation for your new or seasoned LLC, LP or Corporation, an operating agreement or bylaws which you can amend, property insurance, a credit report, title report and appraisal. I will order these last 3 items for you. You do NOT need proof of personal or business income, a personal financial statement, tax returns, and we do not ask about your employment. In many cases, you do not need seasoned assets or bank statements. Specific requirements vary by program.

If you are doing new construction, a renovation or bridge loan with improved pricing or higher loan amounts, we may ask for a track record and a scope of work / budget if it applies. Please obtain your scope in writing from a licensed and insured contractor or subcontractor as per the city or state.

How quickly can we fund the loan?

COE is realistically about 15 business days: est. 5 days for appraisal and title, est. 5 days for quality review and final loan terms, est. 5 days for legal documents and wire. Please be sure everyone is on board with this timeline. On a purchase, you could write the offer as 10-15 days and keep a 10-15 day extension in mind because Realtors deal in calendar days and lenders deal in business days.

Testimonials

Luca's warm and inviting personality is what makes me proud to work with him. I am confident in the skills and work ethic he brings to his clients. Having met him in other rei groups, I'm glad to have the opportunity to work together, creating and morphing Team Sparta into a powerhouse it is!

—Megan Wuebker.

Luca is is a powerhouse when it comes to closing private hard money or DSCR loans for new and seasoned real estate investors. He is able to source capital and just get it done! If you need a loan, call him!

— Kirsten V.

Call (772) 444-5637

Email: [email protected]